IVD industry is developing rapidly, and GPO is the general trend of the development of circulation enterprises. With the expansion of medical insurance coverage, the intensification of population aging and the expansion of commercial health insurance coverage, the IVD industry has entered a period of rapid development.

From the perspective of the industrial chain, the medical reform + upstream pressure will promote the integration of circulation enterprises, while the downstream medical institutions will increase the demand for cost control and efficiency due to the impact of the "drug price reduction and service provision" of the medical reform. We believe that distributors with the advantages of high integration and value-added services will stand out in the same industry.

At present, multinational enterprises account for only about 60% of the market share.

IVD industry ushers in a period of accelerated volume

In vitro diagnosis products mainly include instruments, reagents or systems for in vitro diagnosis. With the gradual clarification of the division of diagnosis and treatment in the medical system and the development of Biochemistry, immunology, molecular biology and other fields, in vitro diagnosis has gradually formed an important part of the medical system.

It is generally believed that the IVD industry can be divided into three development stages:

1. In the embryonic period before the 20th century, some traditional medical diagnostic techniques were used;

2. In the early 20th century, with the discovery of antigen and the development of enzyme reaction in vitro;

3. After 1953, the application of DNA double helix structure, monoclonal antibody technology and macromolecular labeling technology promoted the great leap forward development of the whole in vitro diagnosis industry.

In vitro diagnostic products include reagents, instruments and analytical systems for the collection, preparation (directional treatment) and detection of human samples (including body fluid, cells, tissue samples, etc.).

Generally, the in vitro diagnosis market is mainly divided into four categories: biochemical reagent, immune diagnosis, molecular diagnosis and real-time test (POCT).

According to the blue book data of IVD industry of the Ministry of industry and information technology in 2015, the subdivided fields of in vitro diagnosis account for the top three in its overall market proportion: immune diagnosis (38%) accounting for nearly 40%, biochemical reagents (32%) accounting for nearly 20% and blood diagnosis (Hematology and flow cytometry) accounting for 15%. At present, immunodiagnosis has the largest market share.

.jpg)

.jpg)

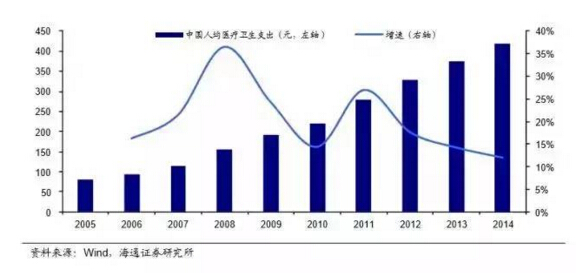

Since 2010, the IVD industry has entered a period of rapid development with the comprehensive effects of factors such as the expansion of the scope of medical insurance, the intensification of population aging and the expansion of the scope of commercial health insurance.

According to Frost & Sullivan's Market Research Report and the IVD blue book data of the Ministry of industry and information technology in 2015, the scale of the domestic IVD market exceeded 14 billion yuan in 2011. By 2015, the market scale of IVD products alone exceeded 44 billion yuan, making it the second largest market segment of medical devices (accounting for 16%). The speed of industry volume is considerable.

From the perspective of per capita IVD expenditure, the European IVD market survey data show that in 2011, the per capita IVD expenditure in Europe reached 145 yuan, the lowest in Romania also reached 25 yuan, while that in China was only 13 yuan, with obvious growth space;

From the demand side of patients, the acceleration of China's aging trend is inevitable in 10-20 years. With the superposition of gradually enhanced national health awareness, both the number of diagnosis and treatment and the frequency of diagnosis and treatment will be increased in the future.

From the perspective of medical institutions, with the deepening of the graded diagnosis and treatment policy and the gradual inclination of financial subsidies to the grass-roots level, the number of grass-roots medical institutions (including class I and II hospitals, community hospitals and various physical examination centers) has increased steadily. At the same time, according to the data of the health and Family Planning Commission, we find that the growth rate of per capita medical insurance expenditure at the grass-roots level has accelerated in recent years and is constantly close to the level of urban residents, The downstream end of the market shows a gradual large-scale trend.

From the implementation effect of drug consistency evaluation, the government has a strong determination to implement medical reform. Therefore, it is conservatively estimated that the favorable policies will last for 5-10 years.

To sum up, the IVD industry has broad development space. In the short term, the favorable policies and the rigid demand of population structure will continue to ferment, and the growth power of the industry is very sufficient.

.jpg)

From the perspective of industrial chain, the upstream of IVD industry mainly includes IVD reagent consumables and instrument suppliers, the midstream circulation link includes agents and distributors at all levels of domestic and foreign production enterprises, and the downstream benchmarking of various medical testing terminals, such as hospital laboratory, medical laboratory, physical examination center and various third-party testing institutions. Most of the company's business is the distribution and agency of IVD consumables and equipment, which belongs to the industrial circulation link. The circulation links are connected up and down, so the changes at both ends of the industrial chain will have an impact on the industry format.

At present, Siemens IVD and Siemens IVD occupy about 90% of the domestic and international brands; The remaining 40% is divided up by domestic powerful enterprises such as Mindray, Kehua biology, Mike biology, Daan gene and Lidman and hundreds of small and medium-sized manufacturers.

From the perspective of channel demand, due to the inherent channel weakness of overseas brands, the downstream penetration is mainly carried out through dealers (such as Kehua biological agent XISEN Meikang), which is highly dependent on the circulation link.

Domestic enterprises have less IVD R & D background than international giants, but they have significant channel advantages. Powerful enterprises can expand horizontally on the basis of deep cultivation of regional market. However, with the improvement of industry concentration, large enterprises with technology, capital and management advantages will stand out from the Red Sea.

In the future, medical reform + upstream pressure will promote the integration of circulation enterprises.

From the perspective of domestic enterprises, since IVD is still a technology driven industry (for example, the breakthrough of enzyme-linked immunosorbent assay technology brings a comprehensive substitution of immune detection for chemical detection), enterprises with technical advantages in subdivided fields are easy to become new competitors at the circulation end, such as Daan gene, Lidman, etc; However, product oriented downstream penetration has obvious restrictions on service optimization, so it is difficult to provide hospitals with service content other than their own products, and the integration advantages of distributors can not be ignored.

For foreign IVD brands, the drug price restriction of medical reform is tantamount to reducing their bargaining power in front of hospital terminals in a disguised manner. Although foreign enterprises will not be affected in the market in economically developed areas in the short term due to technical advantages, with the increasingly significant domestic substitution effect, the dependence of foreign enterprises on distributors will continue to increase in the future.

Downstream end: market stratification is obvious.

IVD downstream market mainly targets 22700 hospitals, 37200 township hospitals, about 450 blood stations, as well as a large number of rapidly emerging physical examination centers and independent medical laboratories.

From the institutional level, the IVD demand of tertiary hospitals in first and second tier cities is relatively saturated, while grass-roots hospitals and health centers benefit from graded diagnosis and treatment, so they are in the stage of rapid development.

Considering the price sensitivity of primary medical institutions, we believe that large dealers and domestic brand agents with the advantage of centralized price negotiation will be in a favorable position in the expansion of primary market.

From the current situation, the "drug price suppression and service provision" of medical reform is the factor that has the greatest impact on the downstream. The cancellation of drug addition forces the hospital laboratory department to put more energy into improving service efficiency and quality on the basis of controlling procurement costs, and the demand shows a diversified trend.

In addition, the rise of third-party Laboratory (ICL) also makes some hospitals outsource some inspection items, so as to achieve the purpose of cost control and efficiency.

Considering the upstream and downstream situation of the industry, we believe that distributors with the advantages of high integration and value-added services will stand out in the same industry.

On the one hand, highly integrated circulation enterprises can solve the problems of single business and poor bargaining power of upstream enterprises. At the same time, the unit cost of products is low and the categories are rich, which puts pressure on the procurement cost of standard hospitals;

On the other hand, the advantages of value-added services improve the service capacity of the hospital laboratory department, improve the profit space of the hospital in a disguised form, broaden the enterprise channels, and have a good extensibility of the business line in the future.

Risk factors: the sinking speed of graded diagnosis and treatment is lower than the expected risk, the risk of insufficient consumption capacity at the grass-roots level, and the risk of intensified market competition.

Source: Haitong Securities Research Report